Renters Insurance in and around Bountiful

Welcome, home & apartment renters of Bountiful!

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

Insure What You Own While You Lease A Home

Home is home even if you are leasing it. And whether it's a townhome or an apartment, protection for your personal belongings is a wise idea, whether or not your landlord requires it.

Welcome, home & apartment renters of Bountiful!

Rent wisely with insurance from State Farm

Why Renters In Bountiful Choose State Farm

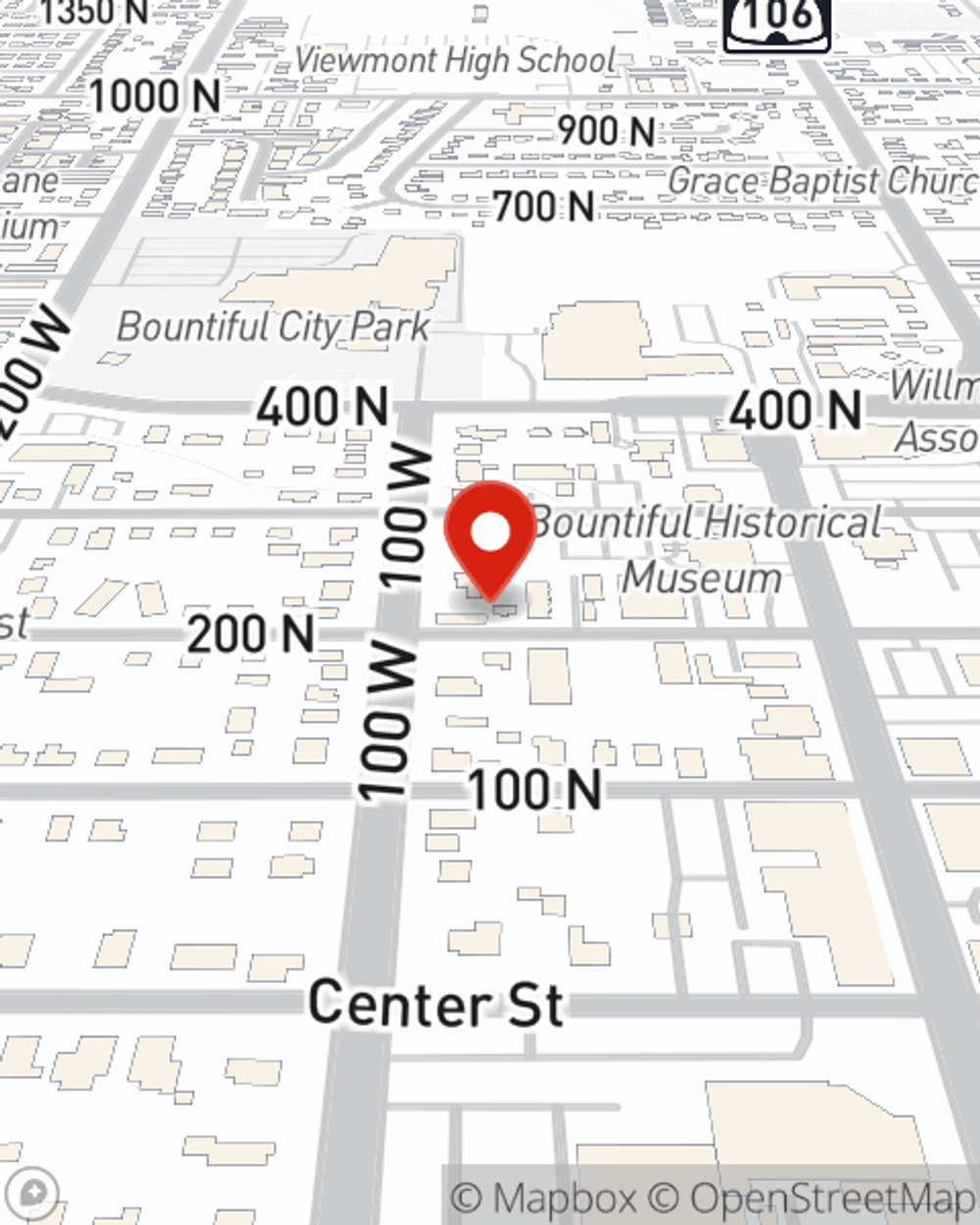

It's likely that your landlord's insurance only covers the structure of the home or space you're renting. So, if you want to protect your valuables - such as a bedding set, a dining room set or a bicycle - renters insurance is what you're looking for. State Farm agent Jone Olson has a true desire to help you examine your needs and keep your things safe.

Renters of Bountiful, call or email Jone Olson's office to explore your individual options and the advantages of State Farm renters insurance.

Have More Questions About Renters Insurance?

Call Jone at (801) 292-8413 or visit our FAQ page.

Simple Insights®

Why should I consider doing home insurance reviews annually?

Why should I consider doing home insurance reviews annually?

You should review your home insurance coverage regularly to ensure you are properly covered. Here are some tips to have a good insurance review.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Simple Insights®

Why should I consider doing home insurance reviews annually?

Why should I consider doing home insurance reviews annually?

You should review your home insurance coverage regularly to ensure you are properly covered. Here are some tips to have a good insurance review.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.